Tax returns have been due in on July 2015, however given the circumstances, the federal authorities have offered a 3 month extension. Regardless of this, commentators nonetheless anticipate as much as 1.4m to fail to offer a return, which CNBC observe will lead to a 5% cost and – worse – funds that could possibly be redistributed to the taxpayer being withheld by the IRS. Taxes could be a troublesome course of, however with a bit of planning and dedication, they are often made straightforward. On the coronary heart of those preparations is a straightforward, however essential, idea – paperwork.

The fundamentals – W2 and 1099-G

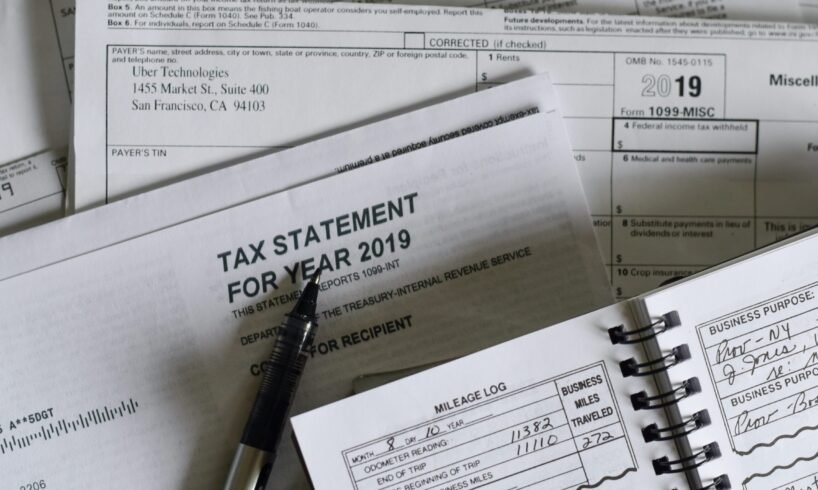

Apart out of your fundamental particulars – title, deal with, social safety – absolutely the must-have doc, supported by proof all year long, is the W2 (for employed individuals) and the 1099-G (for unemployed individuals). Whereas these change in want from case to case, and self-employed professions would require additional proof, they do present the premise for earnings assessments. Whenever you obtain this kind out of your employer, or begin filling it out your self as a self-employed individual, use your time to diligently verify for errors. In response to US Information, the correction course of when amending these kinds might be time-consuming and dear for each the IRS and taxpayer – get it proper first time.

Distinctive earnings

Preserve a thought for any earnings you may have made by way of non-formal employment. This could embrace hobbies, on-line promoting and playing. To take the latter, Investopedia define how playing earnings might be taxed – something over $1,200 ought to be issued a type when paid out by the on line casino in query. If not, the gambler should nonetheless report all the things to the IRS. Preserve an eye fixed out for these small sums which, over time, can add as much as a notable untaxed pot. It should enhance the accuracy of your report and preserve you out of the radar of IRS investigators, finally resulting in your tax affairs being so as and well timed.

Securing your dues

Apart from the authorized requirement to fill out tax returns, the method of tax evaluation can present substantial financial savings. Deductions can vary from Okay-12 educator bills and charitable donations by way of to federally declared catastrophe rebates and residential enhancements for vitality financial savings subsidies. Basically, there’s a large vary of issues you’ll be able to undertake in day by day life that the federal government will enable you a refund for. One of the best ways to maintain organized right here is to maintain paperwork regarding any adjustments or purchases you make to help the house or enterprise; compared towards the rebate textual content and standards, you might be owed prices that you wouldn’t have picked up on in any other case. There isn’t a regulation towards making the request in good religion, even when the IRS deny it.

Cautious administration of your tax affairs is essential to your long-term monetary well being and may, certainly, have an effect in your psychological and bodily well being. Having thorough documentation to help your tax course of is vital on this. Preserve your paperwork; make your self conscious of your rights; and be well timed in your submitting course of.