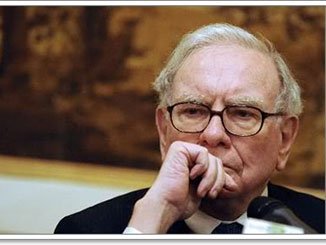

On the annual assembly of Berkshire Hathaway, Warren Buffett suggested concerning the hazard of utilizing hedge-fund managers for funding. In accordance with Buffett, cash spent on plumbers or dentists provides extra worth than on hedge-fund managers. In mixture, funding professionals aren’t value their charges. Buyers can be higher off sticking their cash in a low-cost index fund.

“If you happen to go to a dentist, for those who rent a plumber, in all of the professions, there’s worth added by the professionals as a bunch in comparison with doing it your self or simply randomly selecting laymen,” Buffett, 86, stated. “Within the funding world it isn’t true. The energetic group, the individuals which can be professionals in mixture, are usually not, can’t, do higher than the mixture of the individuals who simply sit tight.”

Vice Chairman Charles Munger, 93, stated “it’s even worse than that” as a result of some hedge fund managers with a protracted profession within the trade — recognized for charging 2 % administration charges and taking 20 % of earnings — do nicely, appeal to cash after which lose it.

“The investing world is only a morass of fallacious incentives, loopy reporting and, I’d say, a good quantity of delusion,” Munger stated.

Buffett additionally challenged, as he has in earlier shareholder conferences, the 2-and-20 compensation mannequin for hedge fund managers.

“If you happen to actually have a billion greenback fund and get two % of it, for horrible efficiency, that’s $20 million,” Buffett stated. “In some other subject, it might simply blow your thoughts.”